Introduction

For many families, the dream of sending a child to college is both exciting and overwhelming. A degree represents opportunity, independence, and a gateway to the world—but it also represents one of the largest financial commitments a family can make. The cost of higher education has climbed significantly over the past few decades, and families everywhere are asking the same question: How can we make this dream achievable without jeopardizing our financial future? If you are thinking that you and your family are in a unique situation, do not fret, many families have to ponder such financial questions at some point during the entire process.

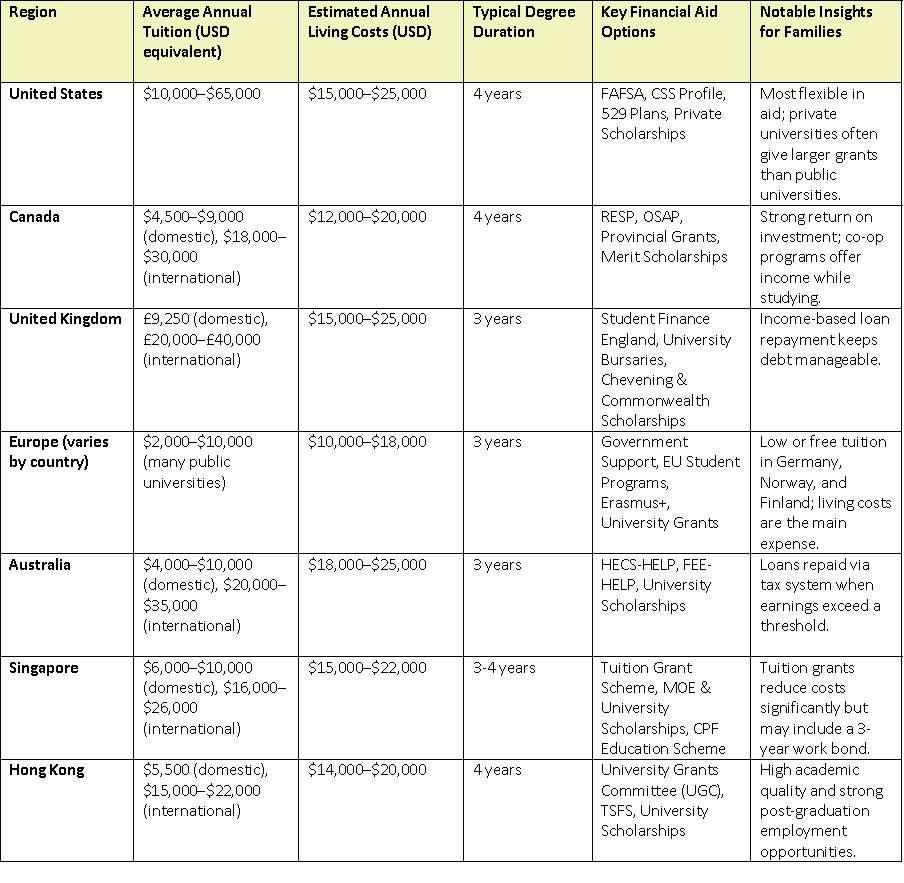

Understanding global college costs and the different financial aid systems—whether it’s a U.S. student loan, a Canadian RESP, or a UK maintenance loan—can help families choose paths that align with both their educational and financial goals. Let’s dive in.

The Big Picture: What Drives College Costs

College costs are influenced by more than tuition. Room and board, travel, health insurance, and living expenses usually account for 30–50% of a student’s total budget. Exchange rate fluctuations and inflation can further complicate matters for international families. For instance, a student studying in London or Sydney might face higher everyday expenses than one in smaller towns or university cities, due to cost of living differences and currency movements.

The duration of study is another important factor to consider. In the U.S. and Canada, most undergraduate programs are four years, while in the U.K., Australia, and parts of Europe, degrees are typically completed in three. That one-year difference can translate into significant savings in both tuition and living costs.

Starting with a clear understanding of the total cost of attendance—not just tuition—is essential for smart planning. Families who take time to calculate the “full picture” often find new ways to make education more affordable, whether through early savings, scholarships, or choosing a region where costs align better with their budget.

United States

The United States remains a top choice for global higher education, but it’s also one of the most diverse—and potentially expensive—landscapes for families to navigate. Tuition alone can range from $10,000 per year at an in-state public university to $65,000 at a private institution. Add room, board, and other living costs, and total annual expenses can easily surpass $75,000 for some students.

That said, the U.S. offers the most robust system of financial aid in the world. The FAFSA process opens doors to federal grants, loans, and work-study programs, while the CSS Profile used by many private colleges helps assess eligibility for institutional aid. Many families are surprised to discover that private universities, though seemingly more expensive, often provide much larger need-based aid packages than public institutions. In many cases, their ability to extend larger aid packages is directly related to their ability to receive donations from alumni for specific scholarships along with their ability to tap into large endowments. To give you examples, the two largest endowments in the U.S. belonged to Harvard University and Yale University, at over $50 billion and over $40 billion, respectively.

Long-term strategies like 529 college savings plans or Coverdell Education Accounts can help families save in tax-advantaged ways. And with over 1.7 million private scholarships available in the U.S., finding “hidden funding” opportunities—local foundations, community organizations, or niche scholarships—is often the key to bridging financial gaps.

Canada

Canadian universities consistently deliver high-quality education at a cost that’s often lower than their U.S. counterparts. Tuition for domestic students typically ranges from CAD $6,000–$12,000, while international students may pay between CAD $25,000–$40,000 per year.

However, the strength of Canada’s system lies in its student support programs. Each province manages its own aid—such as Ontario’s OSAP, Alberta’s Student Aid, or British Columbia’s StudentAid BC—offering loans, grants, and bursaries that prioritize need-based funding. Families who begin saving early can also take advantage of Registered Education Savings Plans (RESPs), which combine tax-free growth with government matching through the Canada Education Savings Grant (CESG).

Living costs vary widely. In smaller cities like Halifax or Winnipeg, annual expenses might stay under CAD $15,000, while in Vancouver or Toronto, they can reach CAD $25,000 or more. Still, many Canadian universities are situated in communities with strong co-op or work-study programs—allowing students to earn while learning and offset living costs through relevant work experience.

United Kingdom

With its world-renowned universities and strong employment outcomes, the United Kingdom remains a popular destination, especially for international students. Domestic tuition is capped at around £9,250 per year in England (and often lower in Scotland, Wales, or Northern Ireland), but international students can expect to pay £20,000–£40,000 annually, depending on their chosen program.

What stands out about the UK system is its repayment flexibility. Through Student Finance England, eligible domestic students receive tuition and maintenance loans that they begin repaying only once they earn above a specified salary threshold. This income-contingent model ensures that repayments remain fair and affordable relative to income.

Scholarships and bursaries are another strong feature of the UK education landscape. Many universities offer financial support for academic merit, financial need, or international diversity. For students earning a postgraduate degree, families can also explore Chevening Scholarships and Commonwealth Awards for international students—programs that cover full tuition and living costs for high-achieving applicants.

Europe

Across continental Europe, families often discover a refreshing approach: broad access to quality education at low cost. Many countries, including Germany, France, Norway, Finland, and Austria, offer low or even free tuition for local and EU students—and in some cases, extend those benefits to international students as well.

For English-speaking families, one of Europe’s strongest developments is the rapid expansion of English-taught bachelor’s programs. Countries like the Netherlands, Denmark, and Sweden now offer hundreds of degrees entirely in English. Even when tuition exists, it’s often a fraction of the cost of schools in the U.S. or U.K., ranging from €2,000 to €10,000 annually.

Families should note, however, that living costs in major cities like Amsterdam or Paris can offset some savings. Yet, access to affordable healthcare, subsidized transportation, and international experience often make Europe an educational and financial win for globally minded students.

Australia

Australia blends rigorous academics with a strong quality of life—and its financing model reflects a deep commitment to educational access. Domestic students rely on the HECS-HELP and FEE-HELP loan programs, which allow tuition to be deferred until the graduate earns above a set income threshold. Repayments are automatically deducted through the tax system, making the process streamlined and manageable.

Tuition for local students averages around AUD $6,000–$10,000 per year, while international students face higher costs—typically between AUD $25,000 and $45,000 depending on the degree field. Australia’s universities are also known for generous scholarship programs.

Living costs are substantial, especially in Sydney and Melbourne, but cities like Brisbane and Adelaide offer more affordable alternatives. Many students also offset costs through part-time work thanks to flexible visa rules that allow them to work up to 48 hours per fortnight during study periods.

Singapore

As a rising global education hub, Singapore combines academic excellence, innovation, and practical career pathways. Tuition for local students averages SGD $8,000–$12,000 per year, but international students typically pay around SGD $20,000–$35,000. Singapore’s Tuition Grant Scheme offers significant subsidies—often covering up to 50% of tuition—for both local and foreign students, though international recipients must fulfill a three-year bond by working in Singapore after graduation.

Singaporean families commonly use the CPF Education Scheme, which allows parents to use savings from their retirement funds to pay for their children’s tuition. Government and institutional scholarships remain plentiful, including those from the Ministry of Education (MOE) and private sector partners who often pair funding with internships or job-placement opportunities.

As a modern, English-speaking city with one of the world’s lowest crime rates, Singapore’s strong infrastructure, high employment rates, and regional economic integration make it a highly pragmatic choice for globally oriented families.

Hong Kong

Hong Kong’s education system is shaped by its East-meets-West heritage. Home to eight publicly funded universities overseen by the University Grants Committee (UGC), Hong Kong offers high-quality programs in business, finance, and technology. Domestic tuition is relatively low, averaging HKD $42,000 per year, while international students pay around HKD $120,000–$170,000 annually.

Financial aid is available through the Tertiary Student Finance Scheme (TSFS) and numerous university-level scholarships focused on merit and need. Even though living costs can be high, Hong Kong’s cultural diversity, proximity to China’s economic centers, and English-language programs add significant long-term value.

Many graduates go on to work in Hong Kong’s robust financial or technology sectors, which means strong career opportunities can offset initial education expenses.

Smart Funding Strategies for Families

Financing a college degree—whether at home or abroad—is ultimately about strategy and readiness. Families can make a big difference by starting early and adopting disciplined habits such as:

Creating a multi-year savings plan. Even consistent small contributions add up when compounded over time.

Diversifying funding. Combine scholarships, savings, and need-based aid rather than relying on one source.

Planning for the unexpected. Exchange rate changes or policy shifts can alter the cost picture for international students.

Encouraging student ownership. Middle and high schoolers who understand costs can contribute through part-time work, budgeting, or scholarship applications.

Evaluating long-term outcomes. Focus not just on upfront expenses, but on return on investment through employability and starting salaries.

Paying for college doesn’t happen overnight, but families who stay organized and proactive often find multiple pathways to affordability.

2026 Global University Cost Comparison

Closing Thoughts From Supreme Prep

Education is an investment—not just financially, but emotionally and personally. Each region offers its own balance of cost, culture, and opportunity. For families, understanding these nuances turns uncertainty into empowerment.

Planning ahead, researching funding options, and seeking professional guidance can make a life-changing difference. A college degree isn’t simply a price to pay; it’s a foundation for growth, independence, and future possibilities.

At Supreme Prep, our mission is to help families navigate every step—from admissions and test prep to financial readiness—so that every student can pursue their dreams with confidence and clarity.

Visit Us: www.supremeprep.com